and Josephine Lorraine Hipkins in Montclair, New Jersey. Bogle was born on to William Yates Bogle, Jr. See also: John Bogle biographical information Early life and schooling

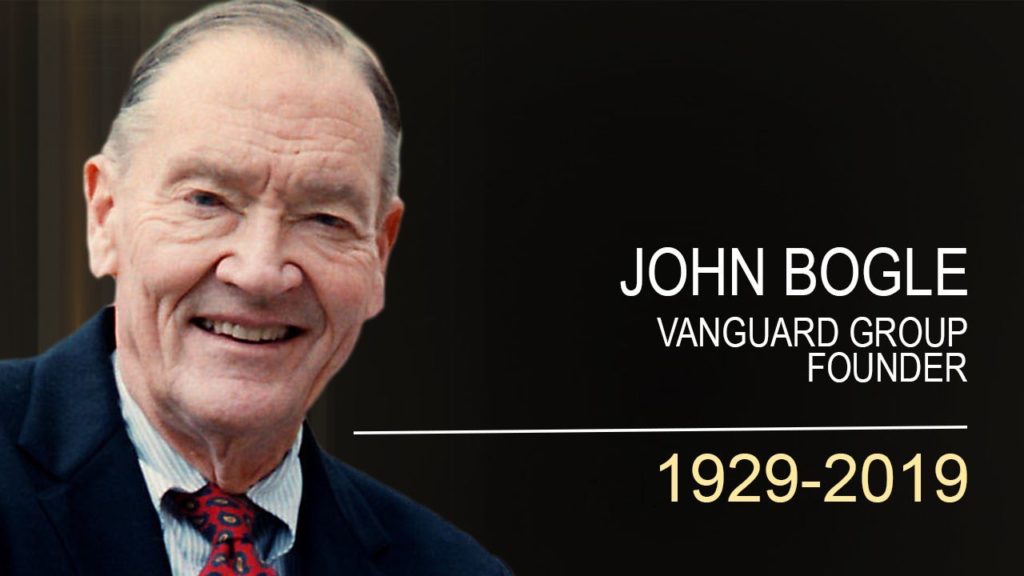

Other mutual fund sponsors are expected simultaneously to make a profit for their outside owners and provide the most cost-effective service to funds for their shareholders. The company says that this structure better orients management towards shareholder interests. Vanguard is unusual among mutual fund companies since it is owned by the funds themselves. John Bogle died on January 16, 2019.įollowers of John Bogle's investment philosophy admire him not just for his eloquence in tirelessly speaking and writing about the importance of fees and advantages of indexing, but in his conscious decision in the creation of The Vanguard Group not to enrich himself at the expense of consumers. Speculation (2012) and Stay the Course (2018). Among his latest books are The Clash of the Cultures: Investment vs. He was president of the Bogle Financial Markets Research Center, whose website contained comprehensive biographical information, as well as a list of books authored and the texts of speeches delivered. Bogle wrote several investing books, and after retiring from the Vanguard Group in 2000, worked tirelessly as an investor advocate. (Jack) Bogle (1929 - 2019), after whom the Bogleheads® are named, was founder of the Vanguard Group and creator of the world's first retail index mutual fund. The Little Book of Common Sense Investing

0 kommentar(er)

0 kommentar(er)